![]() Keith's Note: "Understanding the language of your Phillips 66 retirement plan is the first step toward making confident decisions about your Real Wealth. I’m here to help you translate these terms into real-life strategies that fit your goals." - Keith Demetriades, CFP®, CKA® | Financial Advisor Specializing in Phillips 66 Retirees.

Keith's Note: "Understanding the language of your Phillips 66 retirement plan is the first step toward making confident decisions about your Real Wealth. I’m here to help you translate these terms into real-life strategies that fit your goals." - Keith Demetriades, CFP®, CKA® | Financial Advisor Specializing in Phillips 66 Retirees.

Title I

Actuarial Reduction (Title I): Applies if the benefit is not subject to the early retirement reduction method and is generally 6% per year before the Normal Retirement Date.

Former ARCO Employees: If a former ARCO employee's employment ends before reaching the first of the month nearest to their 55th birthday, their normal retirement income under this plan will be reduced using the actuarial reduction instead of the early retirement reduction.

Early Retirement Eligibility (Title I): The first of the month nearest the participant's 55th birthday.

Early Retirement Reduction (Title I): 5% per year before age 60. This reduction may also apply if employment ends due to certain events (layoff, sale of stock, etc.) in or after the calendar year the employee turns age 50.

Final Average Earnings (FAE): The monthly average of the participant’s highest three consecutive calendar years of annual earnings, chosen from the last 11 calendar years, which includes the year in which the participant’s employment end

Annual Benefit Formula: Final average earnings X 1.6% X Credited Service (up to 576 months) - Primary Social Security X 1.5% X Credited Service (up to 400 months)

Minimum Retirement Income Formula (Title I): $15 x Credited Service (up to 576 months) / 12.

Normal Retirement Date (Title I and Title II): The first day of the month nearest the participant's 65th birthday.

Social Security Make-Up Benefit (Title I): A temporary payment for which a participant may be eligible if they are laid off in or after the calendar year in which they reach age 50, do not continue employment with a successor employer, and begin their retirement benefit before plan age 62.

Eligibility requires the participant was not offered a job with a successor employer at 80% or more of their previous regular monthly earnings rate.

The monthly amount upon commencement is equal to the amount of the reduction for Social Security benefits under the FAE Formula, reduced further by the early retirement factor.

If eligible, the benefit is paid as temporary monthly payments if the participant elects an annuity for their regular benefit, or as a lump sum if they elect the lump-sum option.

Payments cease at the earliest of the month before the participant reaches plan age 62 or the first of the month in which they die.

Title II

Cash Balance Plans (Titles II and VI): For participants in these benefit formulas, the account balance (which is a lump sum) is converted into different annuity payment options (like the Single Life Annuity or Joint and Survivor Annuities). These annuity forms are calculated to be actuarially equivalent to the participant’s Cash Balance Account value.

Credits (Title II)

Interest Credits are applied monthly to the participant's account. This credit is calculated by multiplying the account's value by the Interest Credit Rate, which is based on 30-year U.S. Treasury security rates and is adjusted quarterly.

Pay Credits are calculated monthly by multiplying the participant's eligible monthly pay by a percentage determined by their total "age plus service points" (e.g., 6%, 7%, or 9%).

Eligibility Service (Title II): Employees hired or rehired on or after January 1, 2017, must complete a year of eligibility service (365 days) before becoming eligible to participate in the plan.

Normal Retirement Date (Title I and Title II): The first day of the month nearest the participant's 65th birthday.

Title III

Alliance Refinery Cash Balance Formula: Establishes a cash balance account in name only that holds accumulated credits. A participant’s benefit is based on the value of accumulated credits.

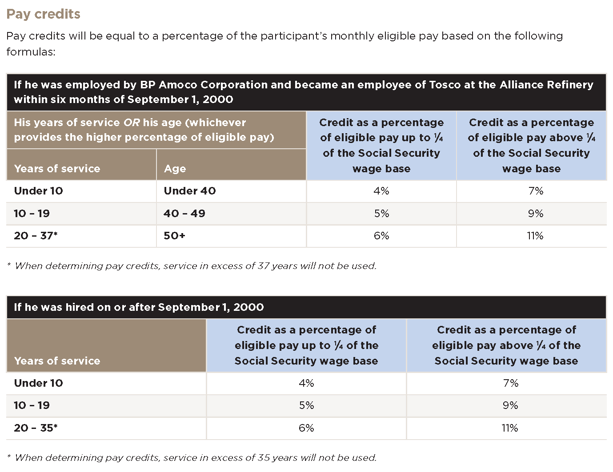

Pay Credits: Monthly credits calculated by multiplying the participant's monthly eligible pay by a specified percentage.

Eligible Pay: Generally, base pay plus regularly scheduled overtime pay, subject to the annual dollar limit set by the Internal Revenue Code.

Pay Credit Formulas:

Interest Credits: Monthly amounts that are calculated by applying the plan’s assigned interest rate to the participant’s cash balance account value as of the last day of the previous month.

The assigned interest rate used for plan years beginning on or after January 1, 2012, is determined by taking the higher of two calculations:

The 30-year Treasury Securities rate for the fourth month prior to each calendar quarter, or

The fixed rate of 1.48%.

Basic Benefit Formula: Calculates a Gross Benefit and then applies offsets for Social Security and, if applicable, prior plan benefits.

Gross Benefit Calculation: Multiply Final Average Compensation (annual average of the participant’s highest 36 consecutive months of compensation out of the last 120 months worked) by 1.6% and by Credited Service.

Final Average Compensation: Annual average of the participant’s highest 36 consecutive months of compensation out of the last 120 months worked.

Social Security Offset: Subtracted from the Gross Benefit to reflect that Social Security is partially funded through company contributions. This offset is calculated using the estimated annual Social Security benefit the participant would receive at age 65.

Prior Plan Offset: If a participant has service with a previous employer, their basic benefit may be reduced by benefits previously accrued under that prior plan.

Deferred Vested Benefit (Title III): The status of a participant in the Tosco Pension Plan who leaves the company before their 55th birthday.

This status applies if the benefit reduction method is the Deferred Vested Benefit reduction.

Normally, this benefit is payable when the participant reaches age 65.

If the participant has at least 10 years of service when they leave the company, they can elect to receive reduced benefits as early as the first of the month on or after their 55th birthday.

Early Retirement Eligibility (Title III): The participant is at least age 55 and has 10 or more years of service.

Early Retirement Reduction (Title III): Applies if the participant is at least age 55 and has 10 or more years of service when they leave the company. The benefit is reduced if the participant has not met the 85-Points Rule and benefits begin before their 60th birthday. If the 85-Points Rule is not met, the payable benefit ranges from 66.67% at age 55 to 100.00% at age 60.

Normal Retirement Date (Title III)

Most Participants: The first day of the calendar month coinciding with or immediately following the participant’s 65th birthday.

Former Phillips Petroleum Company or Mobil Employees: If the 65th birthday occurs between the 2nd and 15th day of the month (inclusive), the Normal Retirement Date (NRD) is the first day of the month in which the 65th birthday occurs. If the birthday falls on the 16th or later day of the month, the NRD is the first day of the month following the 65th birthday.

Title IV

3-Year Average Compensation (High-3) Formula (Title IV)

3-Year Average Compensation: The greater of: the participant’s highest 36 consecutive months of compensation divided by 3 years, or the participant’s highest 3 calendar years’ compensation divided by 3 years.

Credited Service: Generally the years and fractional years in which the participant has been a member of the plan.

Primary Social Security Benefit: The estimated monthly Social Security benefit the participant would receive at the later of their Normal Retirement Age or retirement date.

Gross Monthly Benefit: 3-Year Average Annual Compensation X 1.6% / 12 X Credited Service.

Social Security Offset: Primary Social Security Benefit X 1.5% X Credited Service.

Final Benefit: Gross Monthly Benefit - Social Security Offset.

10-Year Average Compensation (High-10) Formula (Title IV)

Step 1: Determine the 10-Year Average Compensation by dividing the participant’s highest 120 consecutive months of compensation by 10 years.

Step 2: Determine Credited Service, generally the number of years and fractional years in which they had membership service in the plan.

Step 3: Calculate the Monthly High-10 Formula Benefit.

Annual Benefit Factor: Multiply 1% by the first $3,000 of the 10-year average compensation; multiply 1.5% by the remainder of the 10-year average compensation (the amount above $3,000); add these two results together.

Annual High-10 Formula Benefit: Multiply the result from the Annual Benefit Factor calculation by the participant’s credited service.

Monthly High-10 Formula Benefit: Divide the annual benefit by 12.

Actuarial Reduction (Title IV): Applies a reduction based on actuarial factors for participants who undergo a Separation retirement when they are not eligible for the Early Retirement reduction.

Calculation: Multiplying the Normal Retirement Benefit by a reduction percentage based on the participant’s age when the benefit begins and plan rules that take into account interest rates and mortality assumptions at different periods of time.

Early Retirement Eligibility (Title IV): The participant has completed 10 years of service and is at least age 50 but less than age 65.

Early Retirement Reduction (Title IV): If a participant is eligible for early retirement (age 50-64 with 10+ years of service), the participant receives 100% of the benefit at age 60 or older. The percentage decreases for earlier commencement.

Minimum Benefit Formula (Title IV): 12 X Units of Service (years of service) - The Greater of High-3 or High-10 Formulae.

Normal Retirement Date (Title IV): The first day of the month after the participant’s 65th birthday.

Separation Retirement (Title IV): A type of retirement available for a participant who terminated with a vested benefit and is not eligible for Normal Retirement, Early Retirement, or Incapacity Retirement.

Separation Retirement Reduction: Applies if the participant has less than 10 years of service or is under age 50 when their employment ends, meaning they are not eligible for the Early Retirement Reduction. This reduction is calculated based on the participant’s age when the benefit begins and utilizes plan rules concerning interest rates and mortality assumptions applicable at the time of benefit commencement.

Title V - Inactive

Title VI

Actuarial Reduction (Title VI FAE)

Reduction for Early Commencement (Explicit Reductions)

If an FAE Participant elects to start receiving benefits before their Normal Retirement Date, the benefit is reduced because the participant is expected to receive payments for more years.

Early Retirement Reduction (Age 55+ with 10+ years service): The monthly benefit is reduced based on a fixed schedule. For example, the supplemental early retirement benefit is reduced by one-sixth of 1% for each month (2% per year) that the benefits begin before age 65. This percentage applies to the regular benefit as well; for instance, commencing benefits at age 60 results in a 10% reduction compared to age 65.

Vested Termination Reduction (Vested, but ineligible for Early Retirement): If a vested participant commences benefits before meeting early retirement eligibility, the reduction is specified:

The benefit is reduced by 0.4167% for each of the first 120 months (5% per year for the first 10 years) that the commencement date precedes the Normal Retirement Date.

The benefit is reduced actuarially for any additional months preceding the Normal Retirement Date beyond the first 120 months.

Actuarial Equivalence for Payment Forms (Conversions)When the benefit is paid in an optional form, it must be the actuarial equivalent of the standard single life annuity:

Lump-Sum Payment: The lump-sum payment (if the value is greater than $1,000) is the actuarial equivalent of the applicable retirement benefit (early, normal, or deferred retirement benefit). For a vested termination benefit, the lump sum is the actuarial equivalent of the normal retirement benefit.

Single Life Annuity: The amount of the single life annuity is determined by calculating the annuity that is actuarially equivalent in value to a lump-sum payment of the plan retirement benefit payable on the annuity starting date.

Joint and Survivor (J&S) Annuities: The monthly benefit received under a J&S annuity is smaller than a single life annuity because the pension is expected to be paid over two lifetimes. All J&S annuity options (25%, 50%, 75%, or 100%) are actuarially equivalent to the single life annuity.

Actuarial Bases: The process of converting the benefit to a lump sum relies on specific actuarial bases (interest rates and mortality tables) that vary based on when the benefit was earned:

Benefits earned prior to January 1, 2009, use certain 30-year Treasury securities rates and the 1994 Group Annuity Reserving (GAR-94) Table projected to 2002 (a unisex table).

Benefits earned on or after January 1, 2009, use the three segment interest rates derived from the corporate bond yield curve (IRC Section 417(e)(3)) and the mortality table prescribed in IRC Section 417(e)(3).

Actuarial Reductions and Equivalence (Cash Balance Formula)

Single Life Annuity: The single life annuity amount is calculated as the annuity that is actuarially equivalent in value to a lump-sum payment of the Cash Balance Account payable on the annuity starting date.

Optional Annuity Forms: A participant may convert their Cash Balance Account into an actuarially equivalent single life annuity or one of the other actuarially equivalent optional annuity forms.

Joint and Survivor (J&S) Annuities: The monthly amount is smaller than the single life annuity because it is paid over two lifetimes. All J&S annuity options are actuarially equivalent to the single life annuity.

Actuarial Equivalence for Grandfathered BenefitsActuarial equivalence is used to maintain minimum benefit guarantees for participants who converted from the FAE formula:

Initial Conversion: For participants who elected to move from the Title VI FAE benefit formula to the Title VI CB benefit formula, their accrued FAE benefit was converted into an actuarially equivalent lump-sum amount to form the opening balance of their Cash Balance Account effective January 1, 2004.

Minimum Guarantee: The benefit received under the CB formula must not be less than the actuarial equivalent of the accrued FAE benefit (expressed as a single life annuity commencing on the Normal Retirement Date) calculated as of December 31, 2003.

Early Retirement Guarantee: If a CB Participant qualifies for early retirement, the benefit received will not be less than the actuarial equivalent of the early retirement benefits they would have received under the FAE benefit formula, specifically regarding their accrued FAE benefit as of December 31, 2003.

Lump Sum Guarantee: The lump sum paid is the greater of the Cash Balance Account or the lump-sum actuarial equivalent of the accrued FAE benefit as of December 31, 2003, calculated under Title VI provisions.

Cash Balance Benefit Formula (Title VI): Establishes a cash balance account in name only that holds accumulated credits. A participant’s benefit is based on the value of accumulated credits.

Cash Balance Plans (Titles II and VI): The account balance is converted into different annuity payment options.

Pay Credits (Title VI): Applied for each calendar quarter through December 31, 2008. Ceased accumulating on January 1, 2009.

Interest Credits (Title VI): Added to the account for each calendar quarter until the Cash Balance Account is paid out in a lump sum or converted into an annuity. The interest rate for any quarter is the greater of: The effective average annual yield on 10-year Treasury bonds for the month of November of the prior calendar year divided by 4, or 0.65%.

Early Retirement Eligibility (Title VI FAE): The participant is vested, is at least age 55, and has 10 or more years of credited service.

Early Retirement Reduction (Title VI FAE): The benefit is generally reduced by one-sixth of 1% for each month (2% for each year) that it is paid before age 65.

Final Average Earnings (FAE) Benefit (Title VI): Calculates a monthly pension benefit payable as a single life annuity commencing on the Normal Retirement Date.

Calculation Basis: The Final Average Monthly Earnings are the average of your highest-paid 36 consecutive months of employment.

Insufficient Employment: If you have less than 36 consecutive months of employment, the calculation is based on the average earnings during your most recent 36 months of employment (consecutive or not) or your total period of employment, whichever is less.

Included Earnings: Generally include base earnings, overtime pay, shift differentials, pre-tax employee contributions to the company’s Savings Plan and Flexible Benefits Program, and eligible annual non-deferred cash incentive bonuses (when paid). If you have credited service under a predecessor plan, your final average monthly earnings may include amounts recognized as earnings for benefit accrual purposes under that plan.

Excluded Earnings: Payments under nonqualified deferred compensation plans, stock option, stock bonus, capital income and phantom stock plans, severance benefits, unused vacation, and all other commissions and extra or added compensation or benefits of any kind are excluded. Earnings exceeding the IRS’ annual limitations are also excluded.

Monthly Breakpoint: 1/36th of the Social Security wage base in effect in the year the participant leaves the company.

Monthly Benefit Formula: 1.1% of Final Average Monthly Earnings + 0.5% of Final Average Monthly Earnings above the Monthly Breakpoint X Credited Service

Early Retirement Benefit (Title VI FAE): Calculated the same way as the normal retirement benefit, but reduced for early receipt if commenced before the Normal Retirement Date.

Supplemental Early Retirement Benefit (Title VI FAE): 1% of Final Average Monthly Earnings up to the Monthly Breakpoint X Credited Service, reduced by one-sixth of 1% for each month (2% per year) that benefits begin before age 65.

Normal Retirement Date (Title VI):

Cash Balance Participants: The first day of the month coinciding with or next following the later of the participant’s 65th birthday or the earlier of the fifth anniversary of the date the participant began participation in the plan or the date the participant completes five years of service.

Final Average Earnings (FAE) Participant: The first day of the month coincident with or immediately following the later of the participant’s 65th birthday or the completion of five years where this period is measured from the earlier of the date participation began in Title VI or the date the participant completes five years of service.